|

Effective 1 June 2020

1.0 INTRODUCTION

Green Ocean Corporation Berhad (“Green Ocean” or “the Company”) and its subsidiary companies (collectively known as “the Group”) are committed to conduct business with integrity and in good faith while upholding zero-tolerance against all forms of bribery and corruption. We are committed to act professionally, fairly, and with integrity in all business dealings and relationships, wherever we operate as well as complying with all applicable laws, including the Malaysian Anti-Corruption Commission Act 2009 (“MACCA”).

This Anti-Bribery and Corruption Policy (“ABCP”) forms the backbone of the Group’s ABCP compliance programme to all employees and directors concerning how to prevent and deal with improper solicitation, bribery and other corrupt activities and issues that may arise in the course of business.

The ABCP applies to all employees and directors (both executive and non-executive), that they will comply with the relevant parts of the ABCP when performing such work or services.

The ABCP should also be read in unification with other applicable internal policies, procedures, manuals.

2.1 DEFINITION OF BRIBERY, CORRUPTION AND GRATIFICATION

“Corruption” is a form of dishonesty or criminal offense undertaken by a person or organisation entrusted with a position of authority, to acquire illicit benefit or abuse power for one’s personal gain.

“Bribery” is a subset of corruption. Bribery typically involve some form of transaction or transfer of value in exchange for doing something or refusing to do something. A bribe is an inducement or reward offered, promised or provided in order to gain any commercial, contractual, regulatory or personal advantage.

“Gratification” refers to:-

(1.i) money, donation, gift, loan, fee, reward, valuable security, property or interest in property being property of any description whether movable or immovable, financial benefit, or any other similar advantage;

(1.ii) any office, dignity, employment, contract of employment or services, and agreement to give employment or render services in any capacity;

(1.iii) any payment, release, discharge or liquidation of any loan, obligation or other liability, whether in whole or in part;

(1.iv) any valuable consideration of any kind, any discount, commission, rebate, bonus, deduction or percentage;

(1.v) any forbearance to demand any money or money’s worth or valuable thing;

(1.vi) any other service or favour of any description, including protection from any penalty or disability incurred or apprehended or from any action or proceedings of a disciplinary, civil or criminal nature, whether or not already instituted, and including the exercise or the forbearance from the exercise of any right or any official power or duty; and

(1.vii) any offer, undertaking or promise, whether conditional or unconditional, of any gratification within the meaning of any of the preceding paragraphs (i) to (vi).

3.1 TOP LEVEL COMMITMENT

Senior Management of the Company holds a zero-tolerance against all forms of bribery and corruption. This means all employees and directors are required to work in a bribe and corruption free environment while business associates and parties engaged with the Company shall embrace with the integrity stance of the Company.

Senior Management of the Company is primarily responsible for ensuring that the Company:-

(1.i) practices the highest level of integrity and ethics;

(1.ii) complies fully with the applicable laws and regulatory requirements on anti-corruption;

(1.iii) establish, maintain, and periodically review the ABCP and objectives that adequately address corruption risks;

(1.iv) effectively manages the key corruption risks;

(1.v) encourage the use of reporting (whistleblowing) channel as stated in Section 5.2 of this ABCP for any suspected and/or real corruption incidents or inadequacies in the anti-corruption compliance efforts; and

(1.vi) ensure that the results of any audit, reviews of risk assessment, control measures and performance are reported to all Senior Management, including the full Board of Directors, and acted upon.

Meanwhile, Senior Management shall spearhead the Company’s efforts to improve the effectiveness of its corruption risks management framework, internal control system, review and monitoring, and the relevant training and communication initiatives.

4.0 RISK ASSESSMENT

4.1 Corruption Risk Management (“CRM”)

The Group shall adopt CRM. CRM is a management process that helps to identify structural weaknesses that may facilitate corruption, provides a framework for all employees to take part in identifying risk factors and treatments, and embeds corruption prevention within the Group’s operating environment.

CRM adopts a structured corruption risk assessment process. The corruption risk assessment should form the basis of the Company’s anti-corruption efforts. As such, the Company shall conduct corruption risk assessments periodically and when there is a change in law or circumstance of the business to identify, analyse, assess and prioritise the internal and external corruption risks. This risk assessment should be used to establish appropriate processes, systems and controls approved by the Senior Management to mitigate the specific corruption risks.

Employees/directors shall be guided with the corruption risk assessment process as follows:-

Step 1: Identification

Identify the corruption risk scenarios that may arises, determine the root cause and inherent risk on the risk scenarios that arises.

Step 2: Measurement

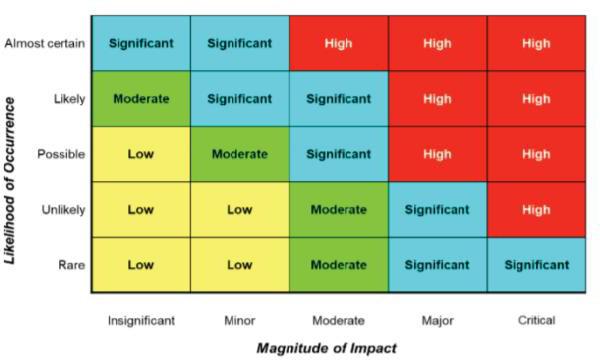

Measure the inherent risks identified by assessing the impact and likelihood of occurrence, assign risk rating for each identified risk thereafter referring to risk matrix below:-

Likelihood of Occurrence

| Likelihood |

Indication |

| Rare |

- low probability, occur only in exceptional circumstances

- approximately < 5% chance of occurring in the next 12 months

|

| Unlikely |

- little probability, could occur at some time

- approximately < 25% but > 5% chance of occurring in the next 12 months

|

| Possible |

- some probability, might occur half of the time

- approximately < 50% but > 25% chance of occurring in the next 12 months

|

| Likely |

- will probably occur in most circumstances

- approximately < 95% but > 50% chance of occurring in the next 12 months

|

| Almost Certain |

- high probability, is expected to occur in most circumstances

- approximately > 95% chance of occurring in the next 12 months

|

Magnitude of Impact

| Impact |

Indication |

| Insignificant |

- business process and planned activities are not disrupted

- no impact on the Company’s reputation and the Management’s integrity

- do not attract media attention

- no penalty

|

| Minor |

- business process and planned activities are lightly disrupted

- light impact on the Company’s reputation and the Management’s integrity

- do not attract media attention

- minimal penalty, may receive notice of violation or warnings

|

| Moderate |

- business process and planned activities are moderately disrupted

- moderate impact on the Company’s reputation and the Management’s integrity

- some loss of public trust

- attract negative media attention

- moderate penalty, may subject to regulatory proceedings

|

| Major |

- business process and planned activities are significantly disrupted

- significant impact on the Company’s reputation and the Management’s integrity

- loss of public trust

- attract negative media attention

- substantial penalty, may subject to criminal charges and/or regulatory proceedings

|

| Critical |

- business process and planned activities are totally disrupted

- extremely serious impact on the Company’s reputation and the Management’s integrity

- severe loss of public trust

- attract negative media attention

- substantial penalty, subject to criminal charges and regulatory proceedings

|

Risk Rating

| Rating |

Course of Actions |

| Low |

- manageable risks where controls are working as intended

- no further action plan needed

- continuous monitoring

|

| Moderate |

- manageable risks where controls are working as intended

- additional prevention measures may be identified

- continuous monitoring

|

| Significant |

- risk must be observed at all time

- existing controls may not effective, additional prevention and control measures must be identified

- superior must be updated about the issue on monthly basis

|

| High |

- risk must be observed at all time

- existing controls are not effective, additional prevention and control measures must be identified

- superior must be updated about the issue on weekly basis

- involve external control mechanism/institution

|

Step 3: Control

Existing controls documented in operating manuals and various policies should be reviewed and physical controls should be tested with walkthrough test.

The effectiveness of the existing controls can be evaluated as follows:-

| Rating |

Condition |

| Effective |

- controls are strong and operating properly,

- provide a reasonable level of assurance that objectives are being achieved

|

| Moderate |

- some control weaknesses/ inefficiencies have been identified

- no serious risk exposure but improvements are required to provide reasonable assurance that objectives will be achieved

|

| Weak |

- controls do not meet an acceptable standard, many weaknesses/ inefficiencies existed

- controls do not provide reasonable assurance that objectives will be achieved

|

Additional preventive and detective control measures are required to be identified for risks that are ranked significant and high as well as those existing controls that are ineffective.

Step 4: Monitor

The identified risks should be monitored and checked periodically and update when necessary.

The Company shall perform a corruption risk assessment and recorded the potential corruption risk scenarios and the relevant mitigation controls. Employees/directors are required to understand clearly and adhere to the relevant actions required in the event you encounter similar incident. However, the list may not be exhaustive, you shall consult your immediate superior or communicate via the reporting channel as stated in Section 5.2 of this ABCP in the event you are uncertain of the situation encountered.

5.0 CONTROL MEASURES

This section covers the Company’s control measures to address any corruption risks arising from weaknesses in the organisation’s governance framework, processes and procedures as well as policies and procedures in dealing with potential bribery and corruption risk areas.

5.1 Due Diligence

The Company shall conduct due diligence on potential or existing clients, business associates, workforce candidates and any other party deemed necessary prior to entering into any formalised relationships and/or as and when there are changes in the circumstances, in particular where there is significant exposure to bribery and corruption risk.

Due diligence methods for background checks may include:-

(1.i) Conduct web searches;

(1.ii) Conduct searches in Companies Commission of Malaysia (“CCM”);

(1.iii) Conduct searches in external databases and screening tools/solutions (i.e. CTOS);

(1.iv) Verify supporting documents;

(1.v) Conduct interviews; and/or

(1.vi) Engage third party due diligence service providers.

Due diligence process should be aimed at obtaining sufficient information to assess whether there are any potential bribery risks posed by the relevant party. Based on the results, we may either decline, suspend or terminate relationship with the relevant party to protect the Company from any legal, financial and reputation risks.

5.2 Reporting Channel

As this ABCP is unable to provide employees with comprehensive solutions to every potential bribery or corruption situation that may arise, employees may discuss the situation with their superior, who will consult with the director and/or then if necessary, with the General Manager for any ethical or legal problems.

Employees or any concerned parties are encouraged to assist in detect, prevent and report instances of bribery, corruption and any other suspicious activity or wrongdoing in good faith. All parties are able to raise concerns in relation to real, suspected or attempted corruption incidents or inadequacies of the anti-corruption programme by contacting the Chairman of the Board and Audit Committee Chairman.

Employees or any concerned parties may refer to the Whistle Blowing Policy of the Company for the whistle blowing procedures.

The Company is committed to ensure the confidentiality of the whistle-blower’s identity and the information reported, to the extent reasonably practicable while prohibit retaliation against those making reports in good faith, to the extent reasonably practicable.

5.3 Conflict of Interest

Conflict of interest arises in a situation where the employee is or may be in a position to take advantage of their role by using confidential information, assets or intellectual property for the benefit of himself/herself or a closely related person. Closely related person is someone you are related to, have personal friendship with, or anyone living in the same household as you. Based on the MACCA, relative includes spouse, siblings, spouse’s siblings, direct line of ascendant (parent/grandparents) or descendant (children/grandchildren) including the spouse’s and the spouse’s siblings, uncle, aunt or cousin, son-in-law or daughter-in-law.

All employees/directors are required to make declaration on conflict of interest on an annual basis or as and when they become aware of a conflict at any other time (ad-hoc basis). Senior management shall determine the next course of action thereafter. Employees/directors may refer to the Company’s Code of Conduct and Ethics for conflict of interest situations examples.

Annual Conflict of Interest Declaration Form shall be kept by the Human Resources (“HR”) Department.

5.4 Gifts

All employees and directors or their family members acting for or on behalf of Green Ocean are prohibited from, directly or indirectly, receiving or providing any item of value, in an attempt to influence the decisions or actions of a person in a position of trust. Under no circumstances should gifts in the form of cash, bonds, negotiable securities, personal loans, airline tickets or use of vacation property be offered or accepted.

It is the responsibility of the employees and directors to politely decline any type of gift which might be considered to compromise good judgement so as to avoid conflict of interest or the appearance of conflict of interest for either party in on-going or potential business dealing between the Company and external parties as gift can be seen as a bribe that in violation of anti-bribery and corruption laws and/or may tarnish the Company’s reputation.

However, there are certain exceptions to the general rule above whereby receiving and provision of gifts are permitted in the following situations:-

(4.i) token gifts of commercial value during festive seasons if the offer/acceptance of such gifts would not place the employee/director in an advantages/compromising position or if offering/refusing the gift would jeopardize client relations;

(4.ii) token gifts from the Company to external parties in relation to the Company’s official functions, events, trainings and celebrations (e.g. door gifts offered to all guests attending the event);

(4.iii) gifts from the Company to employees and directors in relation to the Company’s functions, events and celebrations (e.g. in recognition of the employee’s/director’s contribution to the Company); and

(4.iv) gifts to external parties who have no business dealing with the Company (e.g. monetary gifts or gifts in-kind to charitable organisations).

5.5 Entertainment, Hospitality and Travel Benefits

The Company recognises entertainment and corporate hospitality one of the legitimate ways of networking and to build relationship and goodwill in business environment where else travel benefits can be a legitimate contribution to achieving a business outcome. In this regards, employees and directors should always exercise proper care and judgement before providing and/or accepting entertainment, corporate hospitality and travel benefits to/from third parties especially when it involves public officials to ensure compliance with the anti-bribery and corruption laws. Any entertainment, corporate hospitality and travel activities that would involve public officials shall require prior approval from the Head of Department.

Nevertheless, employees and directors are strictly prohibited to:-

(5.i) accept/provide entertainment, corporate hospitality and travel benefits with the intention to cause undue influence inappropriately on any party in exchange for some future benefit or desirable outcome. Any act of this nature may be construed as an act of bribery;

(5.ii) accept/provide any entertainment, corporate hospitality activities and/or travel benefits that are illegal or in breach of the anti-bribery and corruption laws; and

(5.iii) accept/provide any entertainment, corporate hospitality activities and/or travel benefits that would be perceived as extravagant, lavish or excessive or may adversely affect the reputation of the Company.

Besides, employees and directors should always maintain entertainment expenses within the entitled limit and provide the relevant details and supporting documents to HR Department.

5.6 Donation and Sponsorship

The Company only allows for charitable donations and sponsorships for legitimate reasons as permitted by the existing laws and regulations.

Donation and sponsorship must not be misused as a deception for bribery or avoidance of any of the provisions under the ABCP and anti-bribery and corruption laws. The Company must also ensure that donations to charity is not a channel to fund illegal activities in violation of international anti-money laundering, anti-terrorism and other applicable laws.

The Company does not make or offer monetary or in-kind political contributions to political parties, political party officials or candidates for political office. In very limited circumstances, good faith payments to government entity such as payment to the federal treasury is not prohibited, as long as payment was made with due care to the government entity and not to any individual officials and such contributions are allowed under the applicable laws and regulations. Such contributions must not be made with any favourable treatment in return and must be recorded correctly in the book of the Company.

In this regard, an appropriate level of due diligence shall be conducted to carefully examine the legitimacy of the donation or sponsorship request. In addition, any donation or sponsorship require the prior approval from the Directors or General Manager.

5.7 Facilitation Payments

Facilitation payments are a form of bribery made for the purpose of expediting or facilitating the performance of a public official or political party or decision maker in private sectors for a routine governmental action and/or to obtain or retain business or any improper business advantage. Facilitation payments need not involve cash or other financial asset, it can be any form of advantage with the intention to influence the relevant parties in their duties.

Facilitation payments are illegal under the anti-corruption laws and therefore the employees/directors of the Company are strictly prohibited to offer, promise, give, request or accept anything which may reasonably be deemed as facilitation payment.

In the event these payments are made, it should be reported to the Directors and/ or General Manager as soon as practical.

5.8 Money Laundering

Money laundering arises when criminal origin or nature of money/assets is hidden in legitimate business dealings or when the legitimate funds are used to support any criminal activities. Bribes may occur to facilitate the money laundering process.

Money laundering is a very serious crime and the penalties for breaching anti-money laundering legislation are severe and may include extradition and incarceration in foreign justifications. As such, any practices or activities related to money laundering, including dealing with the proceeds of criminal activities are strictly prohibited.

To prevent violating anti-money laundering laws, employees/directors are expected to conduct counterparty due diligence to understand the business and background of the prospective business counterparty and to assess the potential of money laundering risk.

5.9 Financial Controls

Financial controls are an essential element in the anti-bribery and corruption program. The Company shall practice the following policies and procedures to prevent/deter the occurrence of bribe and corruption:-

(9.i) Segregation of Duties

The Company shall ensure no one individual has exclusive control over an area of financial operations. Finance executive shall prepare/initiate any accounting transactions while the Head of Finance & Administration shall review and approve the relevant transactions.

(9.ii) Delegation of Authorities

Where a process is deemed to pose a higher risk to the Company, for example if a payment is RM50,000 and above, responsibilities should be assigned to the Managing Director together with another 1 authorised signatory. For payment amount below RM50,000, the General Manager or Head of Finance & Administration are required to approve the relevant transaction.

(9.iii) Control over Assets

All the Company’s assets are to be recorded properly in the fixed assets register and all the fixed assets are to be physically inspected once a year during year end. Any addition or write off of the assets less than RM10,000 approve by the Head of Finance and Administration. Any addition of assets more than RM10,000 but less than RM500,000 need approval from Managing Director and above RM500,000 need to obtain the approval from Board of Director. For disposal/ write off of assets, more than RM10,000 but less than RM100,000 need to obtain approval from Managing Director and above RM100,000 need to obtain approval from Board of Director.

Employees/directors are required to make use of the Company’s assets with due care and be responsible for the security of the laptop/desktop assigned respectively.

(9.iv) Cash Control

The Company shall eliminate cash use wherever possible. Minimal cash amount below RM5,000 shall be retained by the Managing Director in the safe, if necessary.

Petty cash records shall be maintained by the Finance Department and reconciliation shall be carried out on quarterly basis, if applicable.

(9.v) External Audit

External audit shall be carried out on the financial statements and records of the Company once a year after the year end so as to provide reasonable assurance on the financial statements.

5.10 Procedures for Reported/Observed Incidents

The Company shall abide the following procedures in the event of reported/observed/suspected acts of bribery and corruption:-

(10.i) Evaluate the evidences. If the evidences are deemed to be insufficient, ensure that the party involved has read and agreed to this ABCP in writing. Keep the relevant party under observation in the event doubts on his/her actions remained; or

(10.ii) If the evidences are deemed to be strong, consult with legal counsel for appropriate actions to take in accordance with the relevant laws and regulations. Possible actions include:-

- Disciplinary measures such as formal warnings and dismissal;

- Cancellation of contracts (with third parties); and

- Police investigation and/or court procedures depending on the case and circumstances involved.

5.11 Records Keeping

All financial records and the relevant supporting documents especially evidence for making payments to third parties must be kept. All accounts, invoices, engagement letters and other documents and records relating to dealing with third parties, such as clients and business associates, should be prepared and maintained with accuracy and completeness.

Employees/directors must declare all gifts, entertainment, hospitality and travel benefits accepted or offered by third parties with estimated/actual value above RM500 to the Finance Department and Finance Department shall keep the relevant records for the Management’s review.

Employees/directors must ensure all expenses claims relating to gifts, entertainment, hospitality, travel benefits or expenses incurred for third parties are submitted to Finance Department together with supporting documents (e.g. payment receipts), third party’s name and their company name as well as reason for the expenditure.

Finance Department should also make the necessary record for any forced facilitation payment incidents.

Human Resource Department should keep proper records on any reported/observed/suspected acts of bribery and corruption.

All the above-mentioned documents are to be kept for at least 7 years.

6.1 SYSTEMATIC REVIEW, MONITORING AND ENFORCEMENT

Senior Management shall ensure that regular reviews are conducted to assess the performance, efficiency and effectiveness of the anti-corruption program, and ensure the program is enforced. Such reviews may take the form of an internal audit, or an audit carried out by an external party. The reviews should form the basis of our efforts to improve the existing anti-corruption controls in place in the Company.

In view of the above, the Company shall:-

(1.i) plan, establish, implement and maintain a monitoring program, which covers the scope, frequency, and methods for review;

(1.ii) identify the competent person(s) and/or establish a compliance function to perform an internal audit, in relation to the Company’s anti-corruption measures;

(1.iii) conduct continual evaluations and improvements on the Company’s ABCP; and

(1.iv) conduct disciplinary proceedings against personnel found to be non-compliant to the ABCP.

7.1 TRAINING AND COMMUNICATION

The Company shall develop and disseminate internal and external training and communications relevant to the anti-corruption management system covering the following areas:-

(1.i) policy;

(1.ii) training;

(1.iii) reporting channel; and

(1.iv) consequences of non-compliance.

7.2 Communication of ABCP

The Company’s ABCP shall made publicly available in the Company’s website, and communicate to all employees/directors via email, Code of Conduct and Ethics while communicate to business associates via email.

7.3 Training

The Company shall provide the employees with adequate training to ensure their thorough understanding of the Company’s anti-corruption position, especially in relation to their role within or outside the Company.

8.0 CONSEQUENCES

Failure for employees/directors to comply with this ABCP shall result in disciplinary action, up to and including termination of employment or dismissal.

Failure for business associates to comply with the relevant sections within the ABCP may result in termination of business relationship with the Company.

Since this ABCP is developed based on legal requirements, violating them could subject the Company and the relevant personnel to penalties including fines, imprisonment and other criminal or civil sanctions. These violations shall result in high costs, loss of professional accreditation or personal reputational damage while severely damage the reputation of the Company.

Section 17A(2) of the MACCA stated that any commercial organisation who commits an offence under Section 17A of the MACCA shall be on conviction be liable to a fine of not less than 10 times the sum or value of the gratification which is the subject matter of the offence, where such gratification is capable of being valued or is of pecuniary nature, or RM1 million, whichever is higher, or to imprisonment for a term not exceeding 20 years or to both.

|